Marketbeat: Poland warehouse market - Q1 2019 [REPORT]

21 may 2019

![Marketbeat: Poland warehouse market - Q1 2019 [REPORT]](https://industrial.pl/storage/posts/May2019/20190522.webp)

Contents

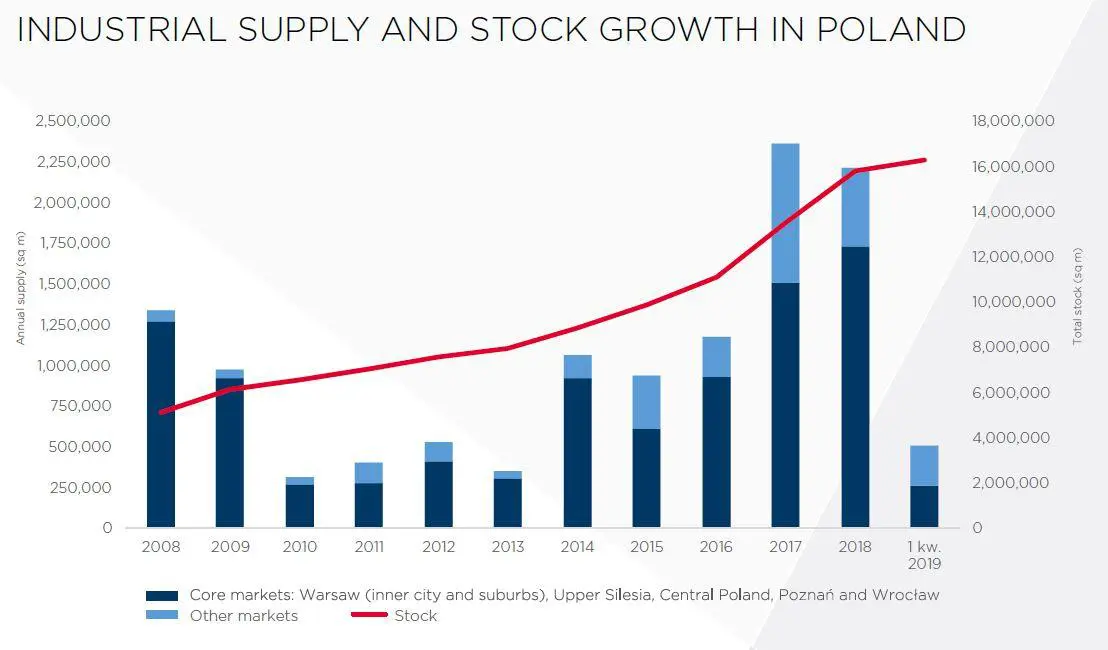

- In Q1 2019, new supply hit 506,000 sq m delivered across 22 projects, bringing Poland’s total warehouse stock up to 16.3 million sq m;

- The largest volumes of warehouse space were completed in Olsztynek (121,000 sq m, Hillwood BTS for Zalando Lounge), Wrocław (94,000 sq m across four projects) and Central Poland (90,000 sq m across five projects);

- Another 2.14 million sq m is under construction, the strongest development pipeline at the end of the first quarter on record;

- Warehouse take-up amounted to 944,000 sq m in Q1 2019, of which 74% was transacted under new leases and expansions while renegotiations made up the remaining 26%;

- The strongest leasing activity was recorded in Warsaw suburbs (236,000 sq m), Wrocław (197,000 sq m), Central Poland (178,000 sq m) and Upper Silesia (154,000 sq m)

- The overall vacancy rate stood at 5.7% (up by 1 pp year-on-year), equating to 934,000 sq m of unoccupied warehouse space;

- Rents remained flat or edged up slightly across most regional markets.

“E-commerce remains one of the key industries driving demand for modern warehouse space in the country. Both large global online platforms and leading retailers and logistics operators whose services are becoming increasingly popular in Poland regularly report new space requirements across all regions. It is worth noting here that e-commerce and the requirements of e-tailing are redefining the concept of a warehouse and setting new challenges for developers. This issue will be further explored in C&W’s pioneering report on warehouse spaces for e-commerce which will come out on 12 June” said Damian Kołata, Associate, Industrial and Logistics Agency, Cushman & Wakefield.

Despite healthy supply levels, the overall vacancy rate edged up by 1 pp year-on-year to 5.7% at the end of March 2019. The highest vacancy rates were in Warsaw Inner City (11.6%, or 89,000 sq m) and in Poznań (8.8%, or 175,000 sq m). Developer activity remains robust with 2.14 million sq m currently under construction across 72 projects. The four markets leading the way in terms of the development pipeline include Upper Silesia (568,000 sq m, 13 projects), Central Poland (454,000 sq m, ten projects), Wrocław (221,000 sq m, eight projects) and Warsaw suburbs (197,000 sq m, nine projects).

Rents in Polish industrial market

Rents remained flat or edged up slightly across most Polish industrial markets in the first quarter of 2019. Amidst a backdrop of strong occupier demand and rising land prices in some locations, developers have become less willing to negotiate rental rates. As a result, the gap between headline rents and effective rents has narrowed due to lower financial lease incentives. The highest headline rents stand at EUR 4.35-5.25/sq m/month for Small Business Units in Warsaw Inner City. By way of comparison, big-box facilities fetch headline rents of EUR 2.40-3.70/sq m/month.

With a 17% growth in its warehouse stock in the last 12 months and more than 2.1 million sq m under construction, the Polish logistics market remains on a strong upward trajectory. While Warsaw and its suburbs, Central Poland and Upper Silesia continue to feature prominently on the radar of occupiers and developers, the Wrocław market is also seeing a considerable increase in activity with supply likely to exceed 300,000 sq m in 2019. Smaller regional markets are also growing; these include Kielce, Rzeszów and Lublin in Eastern Poland, which reported a record-breaking volume of warehouse space under construction (166,000 sq m). Occupiers are also targeting Tricity, Szczecin and the Lubuskie voivodeship, which are becoming increasingly important distribution hubs for goods shipped to Western Europe and Scandinavia.

Despite the rental growth in the past 12 months, the Polish industrial market remains the most competitive market in Central and Eastern Europe. The highest headline rents at big-box facilities are still lower here than in the Czech Republic (EUR 4.25/sq m/month), Slovakia (EUR 3.90/sq m/month), Hungary (EUR 4.50/sq m/month) or Romania (EUR 4.10/sq m/month). Effective rent differentials are also pronounced, further boosting Poland’s competitiveness as a warehouse or industrial destination,” said Joanna Sinkiewicz, Partner, Head of the Industrial & Logistics Agency, Cushman & Wakefield.