The race against time that is, eco-investments in real estate

19 april 2021

Contents

According to “Tracking Buildings 2020” , a report from the International Energy Agency, carbon dioxide emissions from commercial buildings reached 10 Gt in 2019, which was the highest level ever recorded and represented a notable increase after flattening between 2013 and 2016.

Factors that have contributed to this rise include growing energy demand for heating and cooling with rising air-conditioner ownership due to extreme weather conditions. However, the potential for flattening the emissions curve and for reducing emissions remains untapped, the key issue being a lack of effective energy-efficiency policies with insufficient sustainable investments.

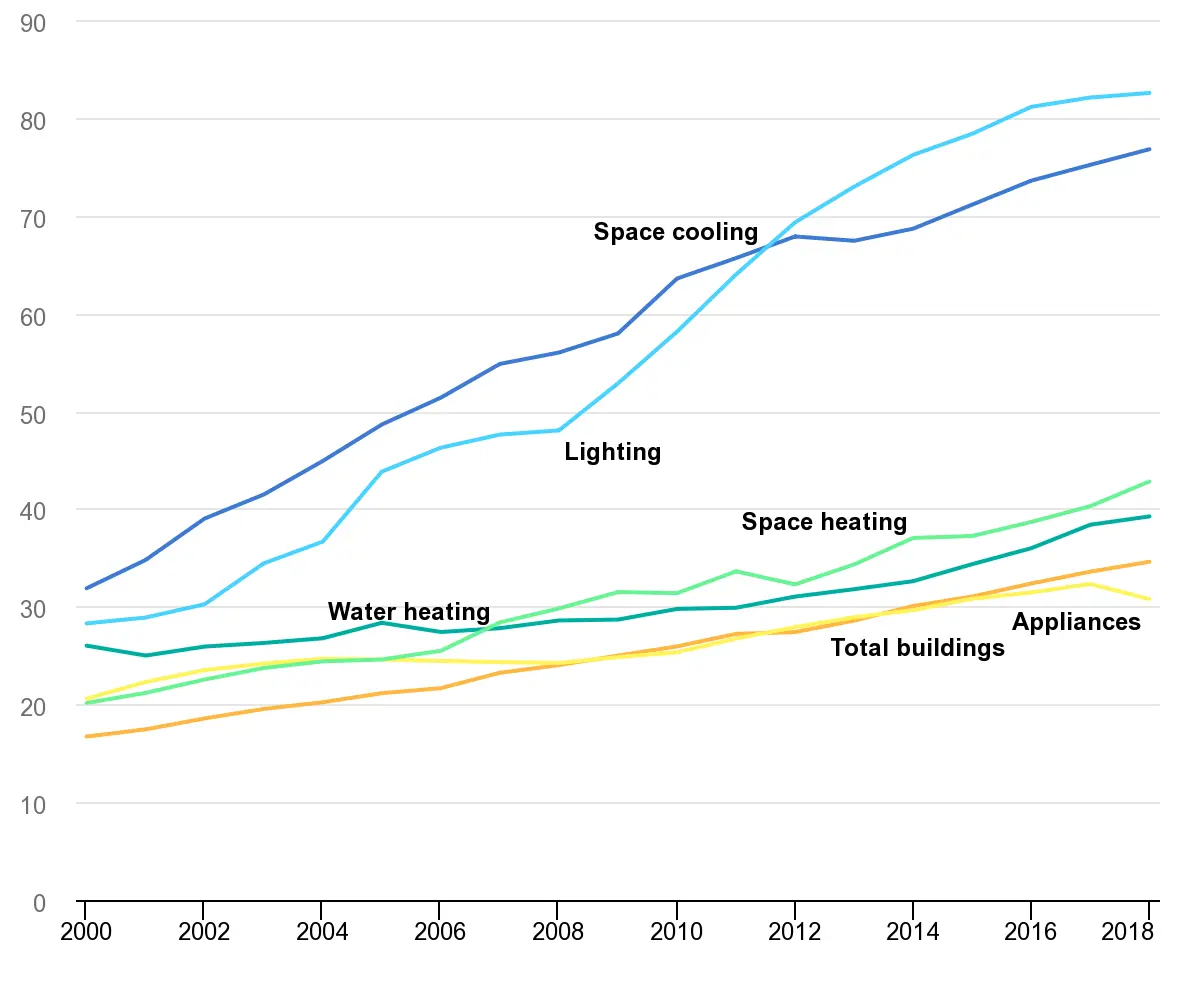

Real estate is a very important sector in terms of environmental sustainability as buildings were responsible for 28% of CO2 emissions. What is the reason for their large share? Buildings require electricity for equipment, machinery and air-conditioners, while demand for energy continues to rise and is also being driven by changing weather conditions. Rising temperatures have driven up demand for cooling and thereby energy consumption. This is supported by statistics as there has been a notable increase in demand for air-conditioning since 2016, which was the hottest year on record.

Source: Policy coverage of total final energy consumption in buildings, 2000-2018, https://www.iea.org/data-and-statistics/charts/policy-coverage-of-total-final-energy-consumption-in-buildings-2000-2018

Sustainable buildings needed now!

On the plus side is the growing volume of sustainable investments in real estate. Improvements in the energy efficiency of building envelopes were especially important in this respect. The material components of a building’s structure such as insulation, windows and air sealing have the biggest impact on energy consumption. The steady growth in demand for such items in recent years is a positive story.

Unfortunately, even though energy efficiency of buildings continues to improve, it still does not offset the growing electricity demand. Gradual building improvements have been decreasing energy consumption by 0.5% to 1% per year. To keep pace with the Sustainable Development Scenario (SDS), energy efficiency must be higher and its annual growth rate must be at least 2.5%.

Legislative changes must keep pace with sustainable investments

Looking ahead, legislation supporting sustainable construction is very likely to become more stringent in the coming years and will certainly be a strong driver of positive change. There are many areas requiring improvements, including the following:

- Energy renovation of existing buildings – we expect this to become a notable trend in the years ahead;

- Wider use of sustainable measures such as heat pumps, a 50% improvement in the performance of air-conditioners, ground heat exchangers, etc.;

- Many green policy measures requiring government support, especially with regard to the following:

- The endorsement of the development of energy efficiency measures to make them more affordable;

- The spread of technologies stimulating positive sustainable changes;

- The engagement of the private sector in implementation of positive sustainable solutions through appropriate financial and regulatory incentives; and

- The government support for energy efficiency technologies to make them more affordable.

The real estate sector is therefore facing a major challenge. It is high time to stop putting sustainable changes off till tomorrow.