Why climate risks should take centre stage in real estate strategies in Poland

27 august 2025

Contents

A higher probability of climate risks materialising in the real estate market

Climate risks can be divided into transition and physical risks. Transition risks relate to regulatory, technological and market changes, such as new environmental regulations or ever stricter requirements for sustainable construction. Physical risks, on the other hand, are direct threats stemming from extreme weather events: floods, heatwaves, hurricanes, or droughts, which have a tangible impact on the functioning and value of real estate.

According to the Climate Risk Index 2025, complied by Germanwatch, Poland ranked 65th among the countries most affected by such risks, moving up 49 places compared to the 1993-2022 period. In response to these growing threats, Polish cities are now required to develop adaptation plans, while investors are increasingly recognising the value of climate risk analyses.

“Amid growing regulatory pressures and climate change challenges, climate risk analysis is becoming not only a component of responsible property management but also a real support for investment decisions. It helps identify threats, plan preventive measures and minimise losses. What’s more, assets resilient to the impacts of climate change are gaining in value, are more frequently chosen by tenants and investors and more easily meet ESG requirements, which are increasingly a prerequisite for securing financing or establishing collaboration with international partners,” says Katarzyna Lipka, Head of Strategic Consulting and ESG Advisory, Cushman & Wakefield.

Climate risks in Poland

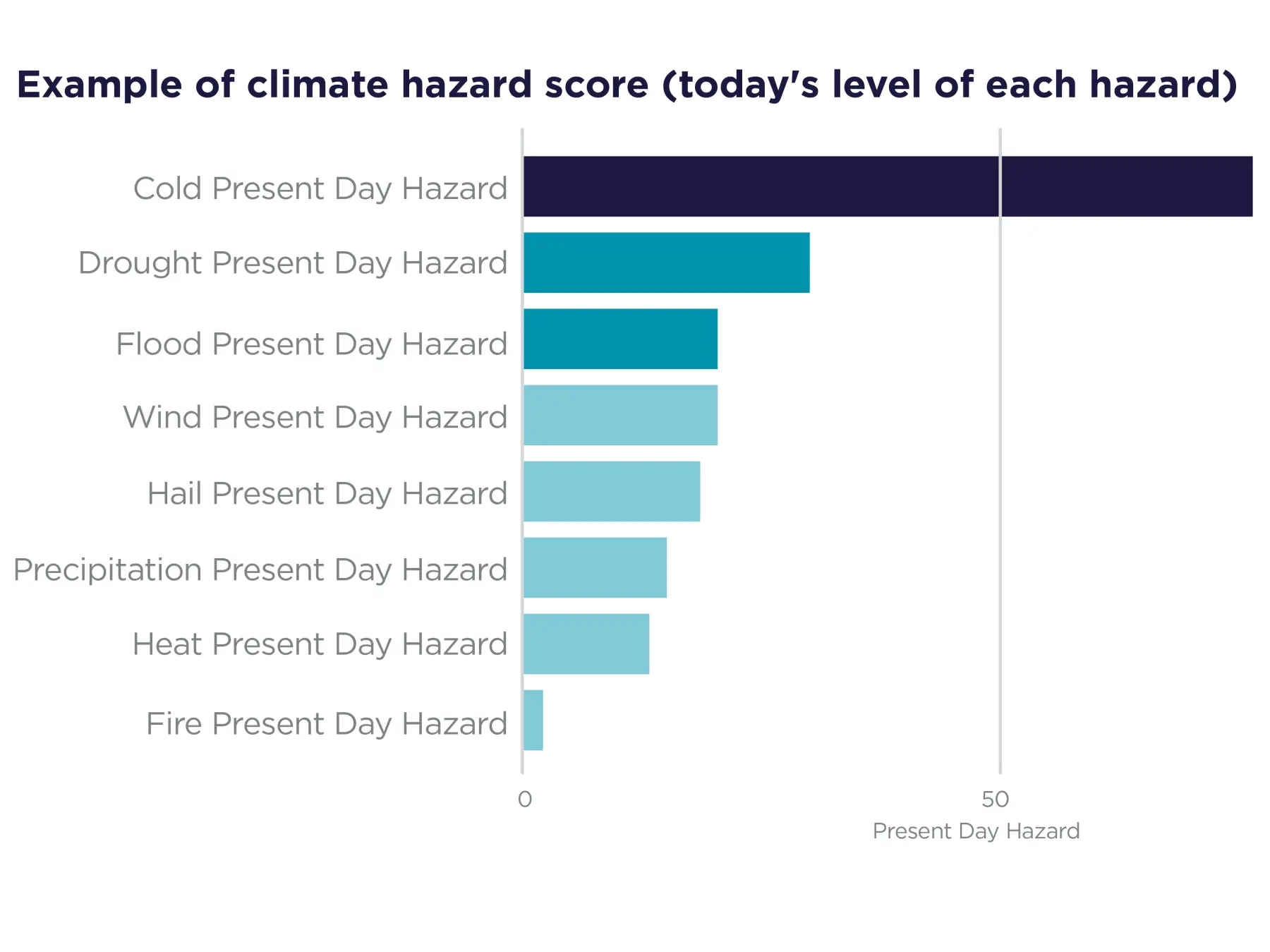

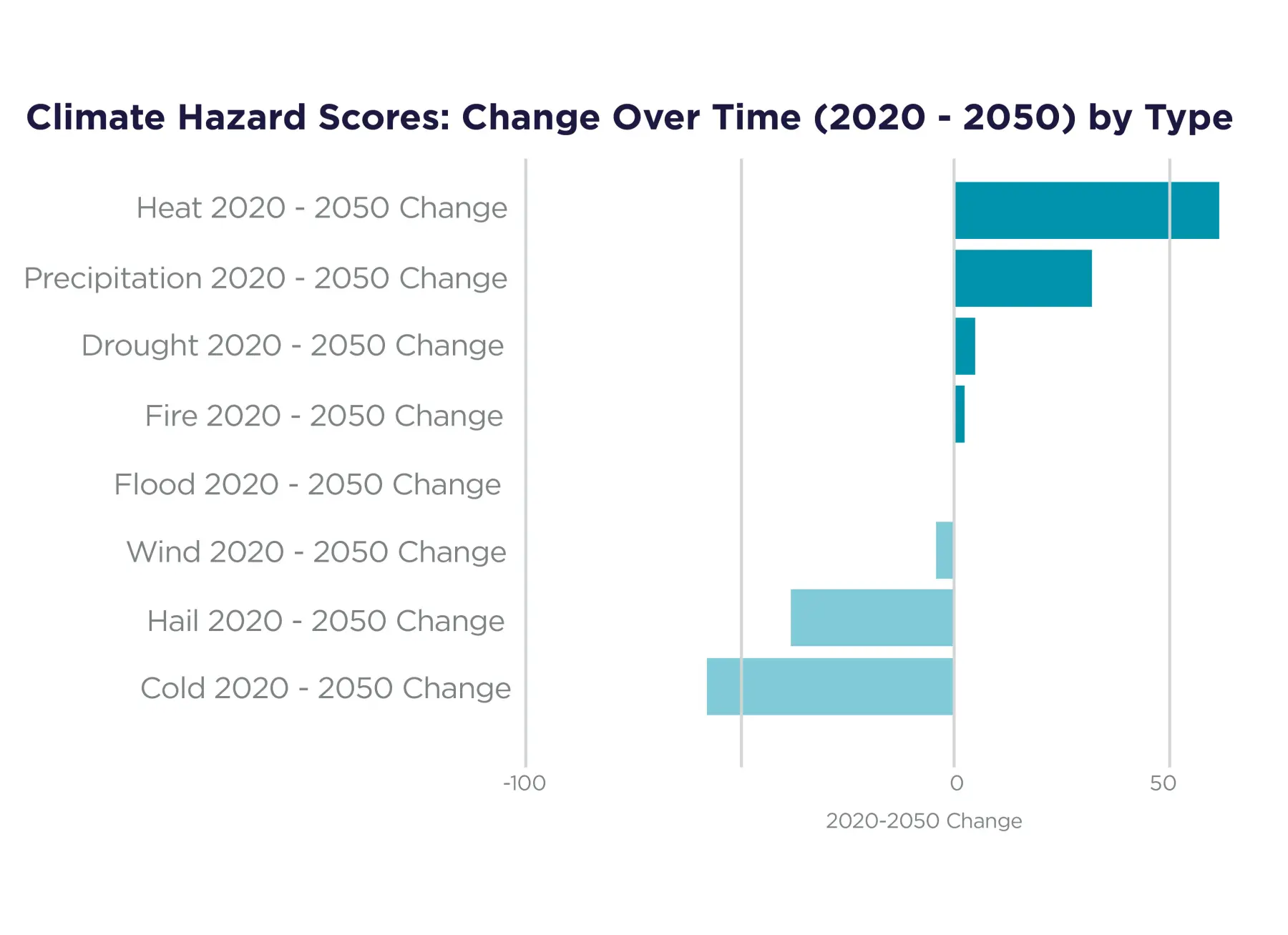

Analyses conducted by Cushman & Wakefield in selected locations across Poland reveal that the most common risks in the country include: high temperatures and heatwaves, heavy rainfall, and – albeit on a downward trend – low temperatures. Significant risks at the local level frequently include strong winds, floods, landslides and – in the case of coastal regions – rising sea levels and coastal erosion.

“Not only the identification of current threats but also an understanding of their long-term trend is key to planning risk mitigation strategies and managing the negative consequences of their materialisation. For example, low temperatures remain a significant risk in many locations across Poland today, but their impact is gradually diminishing. The opposite trend is observed for high temperatures and heatwaves – currently less severe but increasing in intensity – which could have major implications for asset management by 2050,” explains Julia Faltus-James, ESG Services Manager at Cushman & Wakefield.

Good practices in climate risk management – a case study of the industrial sector

According to the authors of Cushman & Wakefield’s Climate Risk: Logistics & Industrial Global Outlook report, climate risk assessment should be a continuous and critical process at many stages in the lifecycle of logistics and industrial assets. It is important that both investors and tenants treat climate risks as a strategic consideration. Specific milestones in the asset management process present the largest opportunity to manage risk effectively and drive property value.

When to complete a climate risk review from an investor’s perspective:

· Planned acquisition: Analysis of risk exposure before acquiring an asset enables accurate valuation and informed investment decisions, including knowing when to walk away from a transaction. The report authors say that their data shows a historical lack of accounting for climate risk exposure, leaving value and opportunity on the table.

· Planning and design: Accounting for projected climate conditions at the design phase is crucial – design for future state, not minimum or historical requirements. At this stage, it is possible to adapt the design to climate risks easily and at a relatively low cost – for example by modifying the HVAC system design or incorporating passive solutions to reduce heat gains from solar radiation. Such measures, when implemented during the design stage, can significantly reduce future operating costs and enhance user comfort.

· Asset management: Regular upgrades and infrastructure investments help minimise climate risk, protect assets and tenants, and improve market liquidity – positively impacting valuations, access to financing and lending conditions.

· Divestment: Preparing an asset for divestment requires an assumption that potential buyers will conduct their own risk analyses, as well as transparent communication of mitigation measures.

When to complete a climate risk review from a tenant’s perspective:

· Site selection: Climate risk analysis during the short-listing stage facilitates negotiations with landlords regarding risk mitigation, lease terms and duration, and rental rates.

· Planning and design: Accounting for projected climate conditions during the design phase and implementing adaptation solutions and risk mitigation measures will enhance a location’s resilience to change.

· Operational management: When planning OpEx and CapEx budgets and updating business continuity plans, it is important to account for the impact of climate risks – for example, higher temperatures increase air conditioning costs.

· Portfolio management: It will allow for proactive management of an entire portfolio with an eye on future climate risks and, where necessary, will provide reasons for exiting high risk locations.

Ignoring climate risks does not eliminate threats – understanding and actively managing them is fundamental to preserving asset value and building a competitive advantage. Both tenants and investors are increasingly integrating climate-related factors into the decision-making process, which is a clear signal of the growing awareness and importance of these challenges in the real estate sector.

“Climate change, along with requirements such as those in the EU Taxonomy, presents new and tangible challenges for the real estate market. It is necessary not only to identify risks but also to evaluate building resilience and implement effective adaptation plans. Buildings with various uses can exhibit varying sensitivities to specific climate risks. For example, the housing sector, where air conditioning is not widely used, can be particularly exposed to user thermal discomfort during heatwaves. Logistics and warehouse facilities, on the other hand, feature lightweight construction, which results in low heat capacity and high thermal dynamics, making them susceptible to extreme temperatures due to building envelope materials. In such cases, it is advisable to deploy solutions that leverage low heat capacity – for example, free-cooling through quick airing. Strategies that reduce the urban heat island effect, such as high vegetation for shading or rooftop materials with high solar reflectivity, can also be crucial. At Cushman & Wakefield, we support municipalities, investors and property owners throughout these processes – from risk analyses in compliance with EU requirements to technical and operational recommendations. Our goal is to assist in making informed decisions and developing assets resilient to the challenges of the decades ahead,” concludes Julia Faltus-James.